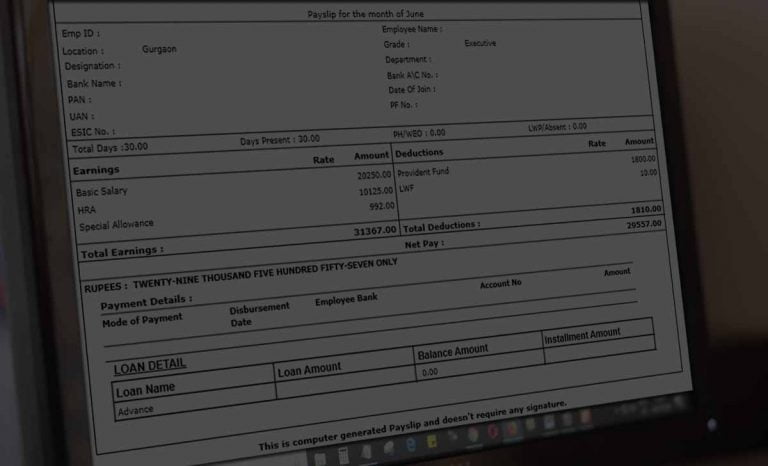

Pay slips are important for employees to keep track of their earnings and deductions, and to ensure that they are being paid accurately and in accordance with their employment agreement.Ī salary slip is a document that an employer provides to an employee, detailing the employee’s salary and any deductions that have been made from it. It may also include information about the employee’s leave entitlements, superannuation contributions, and other employment-related details. The pay slip typically includes the employee’s gross pay (total earnings before deductions), any deductions that were taken out of the employee’s pay, and the employee’s net pay (total earnings after deductions).

PIFRA Salary slip provides the following details.A pay slip is a document that an employer provides to an employee at the end of each pay period, detailing the employee’s earnings and deductions for that pay period. If you can’t find the email in your main inbox, look in the spam folder. An SMS will be delivered to your registered phone number if you correctly fill out the form.Īfter the successful registration, PIFRA will send you a monthly salary slip with information about all your allowances, including medical, emergency, house rent, and pension benefits.Ĭarefully check your email for the salary slip. When the next page loads, carefully type your correct email address twice before pressing the Enter key on your keyboard. ? WHAT TO DO IF YOU DON’T RECEIVE YOUR PAY SLIP?

There are various ways to obtain a Pifra salary slip and registration online, but if you are simply interested in a salary slip from the government, you may find the steps here.

0 kommentar(er)

0 kommentar(er)